The Pag-IBIG Loyalty Card Plus is enhanced with banking features and is now linked to a Prepaid Account by AUB. Your card and account may be used to receive loan disbursements, deposit savings, withdraw from ATMs, pay for groceries and more. You may also use your card to avail of perks and discounts from Pag-IBIG partners as originally used.

You may avail in designated Pag-IBIG Fund Branches. For the complete list of these branches, please refer to the branch locator in www.aub.com.ph/hellopagibig

Approach the Pag-IBIG team at any designated branches to validate your Pag-IBIG membership and get an application form. You may also download an application form from the Pag-IBIG website to get started.

The Pag-IBIG Loyalty Card Plus fee is Php 125.00

AUB is one of the bank partners for the Pag-IBIG Loyalty Card Plus Project. AUB enables the card with a Prepaid Account to receive funds, withdraw and inquire through BancNet ATMs, as well as pay through BancNet POS devices.

You'll need a filled up registration form, at least 1 Pag-IBIG contribution within the last 6 months, a valid government ID, mobile number, and payment.

Kindly input a "-" or dash character in place of your middle name.

To update your Pag-IBIG membership information please visit your nearest Pag-IBIG Branch and approach the information booth for assistance.

The Pag-IBIG Loyalty Card Plus is a combination of Pag-IBIG's loyalty card program and AUB’s Prepaid Account product that allows the card to have ATM functionalities.

Yes, you may keep your old card for loyalty privileges and avail of the new Pag-IBIG Loyalty Card Plus to take advantage of new banking features.

Availing of the Pag-IBIG Loyalty Card Plus powered by AUB automatically enables you to receive loan proceeds directly to your card. You may withdraw the proceeds via BancNet ATMs or use the card directly to purchase goods via POS.

You may only have one active Pag-IBIG Loyalty Plus Card powered by AUB. If you avail of another card from AUB, it will automatically deactivate the previous card. Your prepaid account and funds will be linked to your new card.

With the added benefits of a BancNet ATM Card, you may avail of the following services:

No, your Pag-IBIG Loyalty Card Plus may only be used for ATM and POS transactions. You may avail of the Hello Pag-IBIG Mastercard to transact online. This is a virtual debit card linked to your account that is available for subscription through the Hello Pag-IBIG mobile app.

Your 16-digit card number is located at the back of the Pag-IBIG Loyalty Card Plus.

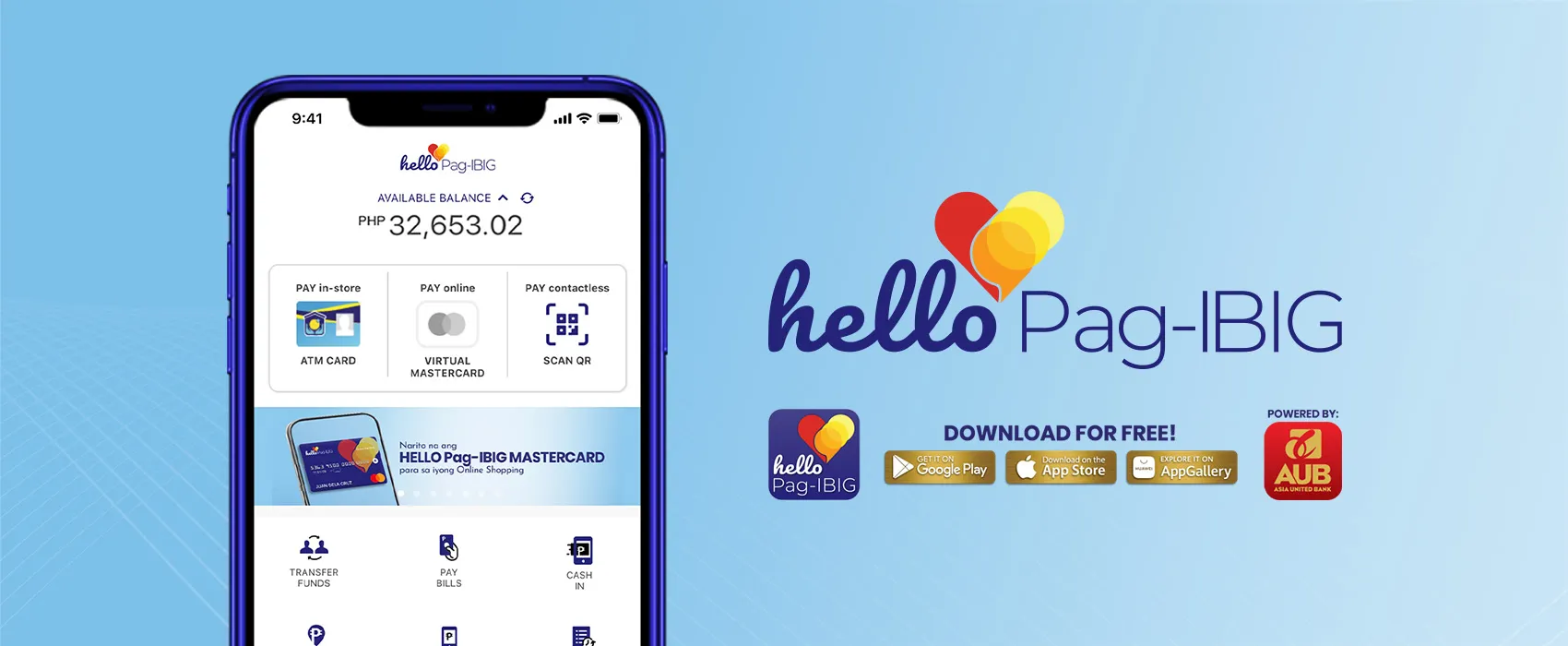

You may go to the nearest BancNet powered ATM and inquire about your balance using your card. You may also download the Hello Pag-IBIG Mobile App to check your balance.

Your AUB Account Number is provided via SMS upon successful registration for the Pag-IBIG Loyalty Card Plus.

You may download the Hello Pag-IBIG Mobile App to view your account number. You may also visit any AUB Branch for assistance in retrieving your account number.

The PIN code of your Pag-IBIG Loyalty Card Plus is found inside the PIN mailer. This is a sealed envelope you will receive together with your card, welcome letter, and brochure. Inside the PIN mailer is a 4-digit PIN linked to your card.

You change your PIN code using any Asia United Bank (AUB) ATM machine. Other ATM machines will not allow you to change your PIN. You may also download the Hello Pag-IBIG Mobile App to change your PIN.

Since your card is linked to an AUB Prepaid Account, you may make a deposit or cash-in transaction to your account. The maximum balance of the account is Php 500,000.00. Your account has no maintaining balance and no dormancy charge.

You may make a deposit or cash-in transaction through the following:

The account may hold up to Php 500,000.00 at any given time. Maximum cash-in transactions are also capped at Php 500,000.00 per month. Transaction limit shall be refreshed on the first day of the succeeding month. You may view your limit through the Hello Pag-IBIG mobile app.

No, over-the-counter withdrawals are not available. You may use your Pag-IBIG Loyalty Card Plus to withdraw using any BancNet powered ATM Machine. In case you would like to transfer your funds to other bank accounts, you may do this through the Hello Pag-IBIG mobile app.

Yes, you may withdraw up to Php 50,000 per day using your Pag-IBIG Loyalty Card Plus.

You may request the nearest branch of the ATM's bank provider for assistance; you may then claim your card from said branch. Please note that if you have lost your card for more than 2 banking days since capture, your card will be deactivated.

Please e-mail us at hellopagibig@aub.com.ph with the Subject ‘Debit Without Dispense’ and include the following information:

Don't worry, you will not lose your Prepaid Account nor balance when you lose your card. Call the AUB hotline at (02) 8282-8888 or 1-800-10-282-8888 and report your card as lost for immediate blocking. You may visit any of the designated Pag-IBIG branches to avail of another card.

The card replacement fee is Php 125.00.

Visit any AUB branch for assistance in checking your card. In case this is defective, we may endorse to have your card replaced for free upon validation.

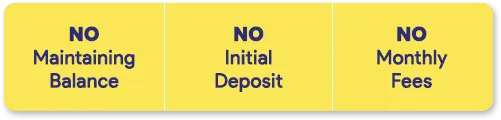

The Hello Pag-IBIG app is a companion app for your Pag-IBIG Loyalty Card Plus. You may register your card for the service to gain access to additional digital banking features for your account.

You need the following to register to the app:

No, you may not. To register for the service, you must have already been issued a Pag-IBIG Loyalty Card Plus powered by AUB. Please go to https://www.aub.com.ph/hellopagibig for more details.

No, you may not. These features are not available through the app. You may contact the Pag-IBIG Fund for further inquiries.

Hello Pag-IBIG provides added convenience in managing your Pag-IBIG Loyalty Card Plus and AUB Prepaid Account:

Your Hello Pag-IBIG account is the same account as your Pag-IBIG Loyalty Card Plus Prepaid Account. Any changes in the balance of your bank account will reflect on both your card and your mobile app.

You do not need to register your new card number. Upon issuance of your replacement Pag-IBIG Loyalty Card Plus, the app will automatically update to your latest active card number.

No, you may not. Your Hello Pag-IBIG account may only be accessed from your registered mobile device.

As an added security feature, you may only access your account on one (1) primary registered device at any time. If you will be registering a new device to your account, simply login from the new device you wish to use then follow the on-screen instructions to proceed.

To unlock your account, press the 'Forgot Password' link on the login page. Follow the on-screen instructions to elect a new password. Once this is done, you will be able to access your account with your new password.

Login your account from a different device and register this as your new primary device in order to block access on previous mobile device.

AUB does not charge for transaction fees. While there are some billers that charge a service fee for processing the transaction, most of our billers in HelloMoney have no transaction fee.

Regarding payment posting, we highly suggest that you check directly with your biller. Your bills payment should be posted within 1-3 banking days.

Automatic reconciliation shall apply within the next banking day which excludes weekends and public holidays. If your transaction is on a Friday, the next banking day is on the coming Monday. If it happens that after such time your funds would remain uncredited, kindly email us at hellopagibig@aub.com.ph with the details of your transaction:

Once you confirm your payment, charges and transfer of funds cannot be reversed. Please ensure to check all details before proceeding with your transaction.

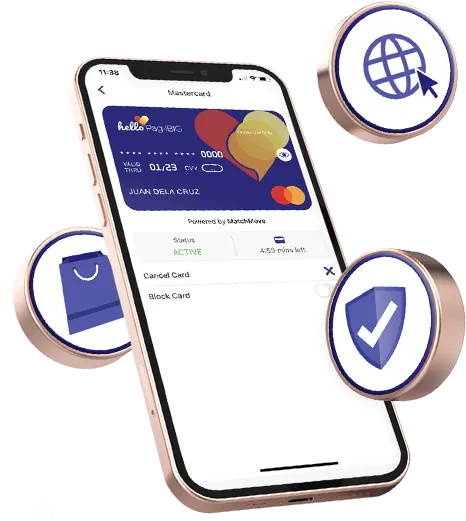

The Hello Pag-IBIG Mastercard is a virtual debit card linked to your Hello Pag-IBIG prepaid account that is primarily used for online shopping payments.

With the Hello Pag-IBIG Mastercard, you can:

You can use the Hello Pag-IBIG Mastercard at any local and global e-commerce sites including subscription-based merchants and online apps accepting Mastercard payments.

No, you may only use the Hello Pag-IBIG Mastercard to shop online. For POS transactions and ATM withdrawals, you may request for a Hello Pag-IBIG ATM card by contacting your preferred AUB branch through our Branch Locator: https://www.aub.com.ph/branch.

Yes, you may shop at any site that accepts Mastercard payments worldwide. There is a service fee of 3.1% (converted to Philippine Peso/PHP) for foreign currency transactions charged on top of your total bill.

No, the Hello Pag-IBIG Mastercard is a virtual debit card with balance equal to the Hello Pag-IBIG prepaid account. It does not earn any reward points or air miles.

The Hello Pag-IBIG Mastercard is a virtual card that can only be accessed through your Hello Pag-IBIG app.

You may follow the steps below to subscribe to the Hello Pag-IBIG Mastercard:

To unsubscribe or cancel your card, tap on the Virtual Mastercard logo then tap on ‘Cancel Card’. Tap ‘Yes’ on the confirmation prompt, then enter your password. Kindly note that should you choose to unsubscribe then resubscribe, you will again be deducted the annual fee of Php 100 from your current balance. Please note that the annual fee is non-refundable regardless of cancellation.

No, the cardholder has the discretion on whether to continue or discontinue subscription to the Hello Pag-IBIG Mastercard.

To view your Hello Pag-IBIG Mastercard number, tap on the ‘eye’ icon at the right hand part of the card. Your 16-digit card number will be revealed.

Kindly ensure that you have an available balance of at least Php 100 for the virtual card’s annual fee. If the issue persists, please e-mail hellopagibig@aub.com.ph with the subject ‘Hello Pag-IBIG Mastercard Subscription Error’.

This means that your Virtual Mastercard is not yet active and that you have not yet subscribed to the Hello Pag-IBIG Mastercard. To activate your Hello Pag-IBIG Mastercard,

The Hello Pag-IBIG Mastercard has an annual fee of Php 100 upon activation. The amount will be deducted from your Hello Pag-IBIG balance upon activation of the card.

Yes, Php 100 will be deducted from your Hello Pag-IBIG balance upon resubscription. New card details will be provided as well. Please note that the annual fee is non-refundable regardless of cancellation.

There is a service fee of 3.1% (converted to Philippine Peso/PHP) for foreign currency transactions. This is on top of your total bill.

All charges made in foreign currencies (whether online, overseas or local transactions) will be automatically converted to Philippine Peso on the posting dates at the prevailing exchange rate determined by AUB.

When you subscribe to Hello Pag-IBIG Mastercard, you hereby authorize AUB to debit your Hello Pag-IBIG account for an annual fee amounting to PHP100. In return, the user will have access to online Mastercard payments worldwide and be entitled to all Mastercard exclusive deals and AUB Cards perks.

Tap on the Virtual Mastercard logo in your Hello Pag-IBIG app, then click on ‘Request CVV’. You may only request for a CVV if your card is active.

Your CVV is the 3-digit number below your card number and beside the ‘Valid Thru’ date.

Your Hello Pag-IBIG Mastercard’s dynamic CVV expires after five (5) minutes and is only valid for one (1) transaction. Once a transaction using your virtual Mastercard is made or the CVV is expired, the user shall initiate another request for CVV.

For security purposes, your card’s CVV changes and expires after 5 minutes or after a transaction is made. You may tap on “Request CVV” after every transaction.

Yes, you may change your current CVV by tapping on the card duration beside ‘Status’. Tap on ‘Yes’ for the prompt ‘Do you want to make another transaction?’. Afterwards, your CVV will change and the expiry period will reset to five (5) minutes.

Please ensure that the status of your card is ‘ACTIVE’ and not ‘BLOCKED’.

You may block your card if you feel that your card details might have been compromised. While your card is blocked, you may not request for a new CVV. You may also opt to cancel your card through the app. Kindly note that should you choose to resubscribe to Hello Pag-IBIG Mastercard, you will again be deducted the annual fee of Php 100 from your current balance. To report any incidents, e-mail customercare@aub.com.ph and hellopagibig@aub.com.ph.

On your Hello Pag-IBIG app, tap the ‘Virtual Mastercard’ icon, then tap on the ‘Block Card’ button. The button should turn orange once the card is successfully blocked, and the ‘Status’ of the card should read ‘BLOCKED’.

The Hello Pag-IBIG Mastercard is valid for five (5) years or as indicated in the ‘Valid Thru’ date on the virtual card.

Please ensure that you have a good network signal and stable internet connection to receive the SMS OTP. You may click on the “Resend OTP” if available on the merchant’s page.

Thank you for raising your concern and we apologize for any inconvenience caused. This issue may be due to the following reasons:

Kindly ensure that the first 4 items have been checked. Otherwise, you may retry the transaction using your Hello Pag-IBIG Mastercard.

Thank you for raising your concern and we apologize for any inconvenience caused. Automatic reconciliation shall apply after one (1) banking day. Should your funds remain uncredited even after the said period, please contact us again.

To report an incident regarding your Hello Pag-IBIG account, you may contact AUB Customer Care through the following numbers: Metro Manila: +63(2) 8282-8888, Domestic Toll-Free Number: 1-800-10-282-8888, or via e-mail at customercare@aub.com.ph and hellopagibig@aub.com.ph.

Thank you for raising your concern and we apologize for any inconvenience caused. For us to further assist you, kindly provide the following information:

Reminder: Your bank will NEVER ask for your CVV.